Dave ramsey chapter 2 answer key – Welcome to the ultimate guide to Dave Ramsey’s Chapter 2, where you’ll unlock the secrets to financial success. This chapter provides a comprehensive roadmap to managing your finances, eliminating debt, and building a secure financial future. Get ready to transform your financial landscape with the proven principles Artikeld in this chapter.

Dave Ramsey, the renowned financial expert, shares his time-tested strategies for taking control of your finances. Through the snowball method, budgeting, emergency funds, and retirement planning, you’ll learn how to overcome financial challenges and achieve your financial goals.

Dave Ramsey’s Chapter 2 Overview: Dave Ramsey Chapter 2 Answer Key

Dave Ramsey’s Chapter 2 Artikels fundamental principles for financial success, including understanding debt, budgeting, saving, and investing. By grasping these principles, individuals can take control of their finances and achieve their financial goals.

The Snowball Method, Dave ramsey chapter 2 answer key

The snowball method is a debt repayment strategy that prioritizes paying off the smallest debt first, while making minimum payments on all other debts. As each debt is paid off, the freed-up funds are applied to the next smallest debt.

This method helps individuals build momentum and gain a sense of accomplishment.

Budgeting and Tracking Expenses

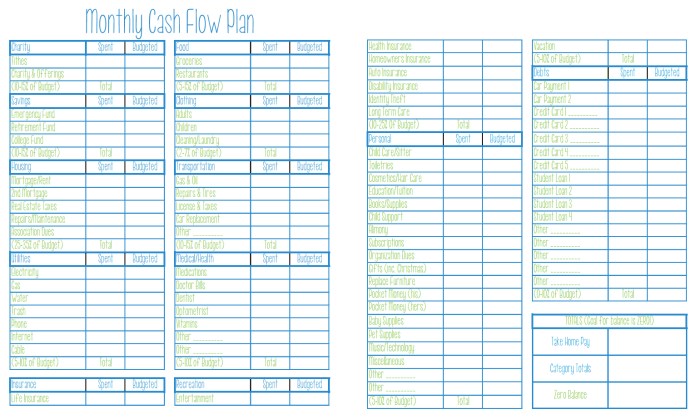

Creating a realistic budget is crucial for financial success. Budgeting involves tracking income and expenses to identify areas where spending can be reduced. By using budgeting tools or apps, individuals can stay organized and accountable for their financial decisions.

Emergency Fund

An emergency fund provides a financial safety net for unexpected expenses, such as medical bills or job loss. Having an emergency fund reduces stress and prevents the need for high-interest debt. Aim to save 3-6 months’ worth of living expenses.

Investing for Retirement

Investing for retirement is essential to secure financial stability in later years. Starting early and investing consistently allows for the power of compound interest to work its magic. Diversify investments to reduce risk and maximize returns.

FAQ Section

What is the snowball method?

The snowball method is a debt repayment strategy where you focus on paying off the smallest debt first, regardless of interest rates. Once the smallest debt is paid off, you roll the payment amount over to the next smallest debt and continue the process until all debts are paid off.

Why is budgeting important?

Budgeting is essential for tracking your income and expenses, ensuring that you live within your means. It helps you prioritize spending, allocate funds effectively, and avoid overspending.

What is an emergency fund?

An emergency fund is a savings account set aside for unexpected expenses, such as medical emergencies, car repairs, or job loss. It provides a financial cushion to prevent you from going into debt or depleting your savings in the event of unforeseen circumstances.