Suppose you know that a company’s stock currently trades at $10 per share. What does this tell you about the company’s financial health and prospects? This guide will provide you with the knowledge and tools you need to analyze a company’s stock and make informed investment decisions.

In this guide, we will cover the following topics:

- Stock market overview

- Stock analysis

- Company research

- Stock valuation

- Risk assessment

Stock Market Overview

The stock market is a platform where stocks, representing ownership shares in publicly traded companies, are bought and sold. It serves as a crucial indicator of economic health and provides investors with opportunities for capital growth and income generation.

There are various types of stocks, each with distinct characteristics. Common stocks represent ownership and provide voting rights, while preferred stocks offer fixed dividends but no voting rights. Growth stocks are issued by companies with high growth potential, while value stocks are issued by companies that are undervalued relative to their intrinsic value.

Stock Analysis

Stock analysis is essential for investors to make informed investment decisions. It involves evaluating a company’s financial performance, industry outlook, and management team.

Technical analysis uses historical price data to identify trading patterns and trends. Fundamental analysis focuses on a company’s financial statements, management, and industry to assess its intrinsic value.

Company Research

Thorough company research is vital before investing in any stock. Investors should analyze key financial metrics such as revenue, earnings, and cash flow to assess a company’s financial health and growth prospects.

Financial statements provide valuable insights into a company’s operations, profitability, and financial position. Interpreting these statements can help investors identify key trends and make informed investment decisions.

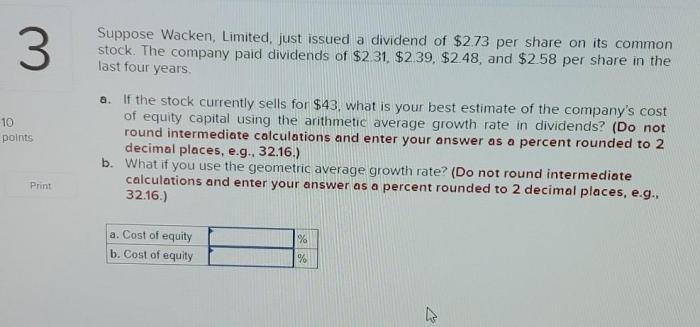

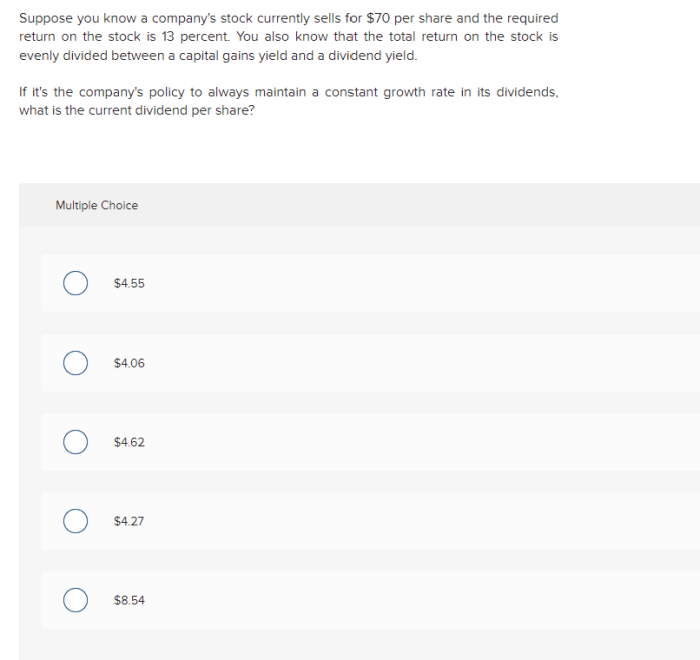

Stock Valuation

Stock valuation is the process of determining the fair value of a stock. It helps investors assess whether a stock is overvalued or undervalued, and make investment decisions accordingly.

Discounted cash flow (DCF) is a valuation method that calculates the present value of a company’s future cash flows. Comparable company analysis compares a company to similar companies in the same industry to determine its relative valuation.

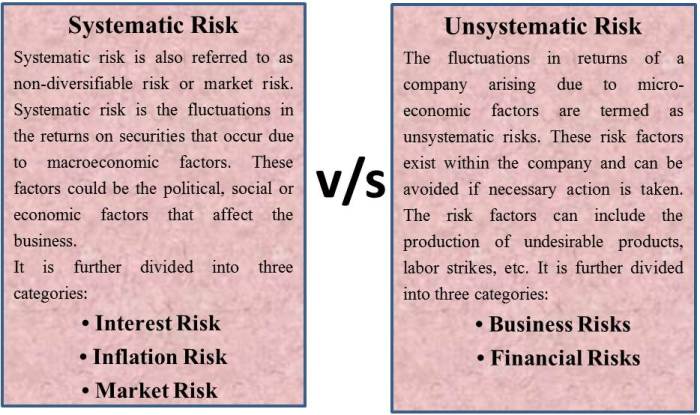

Risk Assessment, Suppose you know that a company’s stock currently

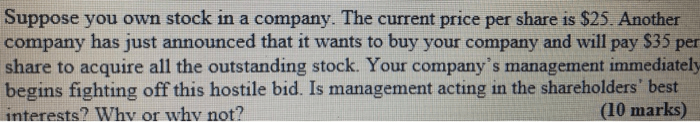

Risk assessment is crucial in stock investing as it helps investors understand the potential risks associated with their investments.

Market risk is the risk associated with overall market fluctuations. Company-specific risk is the risk associated with a particular company’s performance. Diversification and portfolio management can help mitigate risks by spreading investments across different assets and industries.

Answers to Common Questions: Suppose You Know That A Company’s Stock Currently

What is the stock market?

The stock market is a marketplace where stocks are bought and sold. Stocks represent ownership in a company, and when you buy a stock, you are essentially buying a small piece of that company.

What is stock analysis?

Stock analysis is the process of evaluating a company’s stock to determine its value. There are two main types of stock analysis: technical analysis and fundamental analysis.

What is company research?

Company research is the process of gathering information about a company to assess its financial health and prospects. This information can be found in the company’s financial statements, press releases, and other public documents.

What is stock valuation?

Stock valuation is the process of determining the value of a company’s stock. There are a number of different stock valuation methods, each with its own advantages and disadvantages.

What is risk assessment?

Risk assessment is the process of identifying and evaluating the risks associated with investing in a stock. These risks can include market risk, company risk, and economic risk.